Why Does the TCP Section of the CPA Exam Have the Highest Pass Rates?

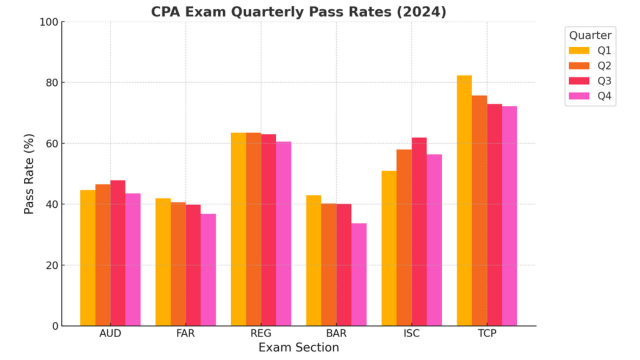

The Tax Compliance and Planning (TCP) section of the CPA Exam consistently achieves the highest pass rates among all sections, sometimes exceeding 80% in a single quarter. Several critical factors contribute to the success rate of candidates taking the TCP CPA Exam:

1. Focused and Well-Prepared Candidates

Candidates pursuing the TCP CPA Exam typically have strong tax backgrounds, often excelling previously in the Regulation (REG) section. Many are Enrolled Agents (EAs) or tax staff professionals, bringing significant knowledge and real-world experience that translates into better preparation, deeper understanding, and higher confidence levels.

2. Content Overlap with the REG Section

The TCP CPA Exam builds directly upon concepts learned in the REG section. This content overlap allows candidates to reinforce and expand their prior knowledge, resulting in a more efficient and effective study process. Familiarity with key tax principles provides a considerable advantage when preparing for TCP.

3. Practical and Relevant Material

The TCP CPA Exam focuses heavily on practical, real-world tax compliance and planning scenarios. Candidates with academic training or professional experience in taxation find the material highly applicable, making it easier to grasp complex concepts and apply them under exam conditions.

4. Clearer and Simpler Questions

Recent AICPA-released TCP CPA Exam questions are written in a clear and straightforward manner. This simplicity enhances candidates’ ability to interpret and answer questions correctly, improving overall pass rates. You can explore detailed explanations of these newly released questions through Farhat Lectures.

Prepare Effectively for the TCP CPA Exam with Farhat Lectures Using the 2025 AICPA Questions

Excelling on the TCP CPA Exam requires both comprehensive technical knowledge and practical application skills. Farhat Lectures offers a complete study solution, featuring thorough video explanations for the 2025 AICPA-released multiple-choice questions (MCQs) and simulations. These resources cover all major topics tested on the TCP CPA Exam, including:

- Individual Income Taxation: Alternative Minimum Tax (AMT) adjustments and passive activity loss limitations.

- Employee Stock Compensation: Proper handling of Incentive Stock Options (ISOs) for tax purposes.

- Gift Tax: Accurate calculation and reporting of taxable gifts.

- Education Savings: Strategies for maximizing tax benefits through 529 plans.

- Corporate Taxation: Understanding dividend distributions, gain recognition, and corporate liquidations.

- Consolidated Tax Returns: Addressing intercompany transactions and eliminating duplication.

- International and Special Taxes: Applying the rules for Base Erosion and Anti-Abuse Tax (BEAT) and Foreign-Derived Intangible Income (FDII).

- Partnership Taxation: Managing basis adjustments, liability sharing, and distributions.

- Entity Classification: Making appropriate elections and understanding liability protection for LLCs.

- Property Transactions: Addressing basis rules after involuntary conversions and the implications of Section 1245 depreciation recapture.

Master the TCP CPA Exam with Farhat Lectures

Success in the TCP CPA Exam demands a detailed understanding of tax law and the ability to apply knowledge to real-world scenarios. Farhat Lectures provides the structured, in-depth preparation necessary to help you approach the TCP section with confidence, using the latest 2025 AICPA-released materials.

Start your journey to CPA success today by accessing exclusive TCP resources at FarhatLectures.com.

Responses