Accounting Changes and Error Corrections: A Comprehensive Guide 2024

Introduction

“Accounting Changes and Error Corrections” is a fundamental concept in financial accounting, representing a critical framework designed to ensure financial statements’ accuracy, reliability, and comparability. This concept addresses the procedures and disclosures that entities must follow when they need to change an accounting principle, adjust an accounting estimate, alter the structure of their reporting entity, or correct errors from previously issued financial statements. These elements are essential for maintaining the integrity of financial reporting, which supports the decision-making processes of investors, creditors, and other stakeholders who rely on financial information.

Changes in Accounting Principles (Accounting Changes)

Changes in Accounting Principles are a significant aspect of financial reporting that occurs when an entity decides to adopt a different accounting policy from the one it previously used. This shift can be prompted by various factors, including the introduction of new accounting standards, the desire to provide more relevant and reliable financial information, or the necessity to comply with regulatory changes. Understanding these changes is crucial for stakeholders, as they can significantly affect how a company’s financial performance and position are presented and interpreted.

Definition and Examples

An accounting principle is a rule or guideline that dictates how financial transactions and elements should be recognized, measured, reported, and disclosed in the financial statements. Examples of accounting principles include revenue recognition, inventory valuation methods (such as FIFO or LIFO), and depreciation methods (such as straight-line or declining balance).

A change in an accounting principle might involve shifting from one generally accepted accounting principle (GAAP) to another, or it could involve adopting a new principle that has become accepted as a result of changes in the accounting standards (for instance, moving from IAS 17 to IFRS 16 for lease accounting).

Reasons for Changes

- Regulatory requirements: Changes in accounting standards issued by standard-setting bodies (like the Financial Accounting Standards Board in the U.S. or the International Accounting Standards Board globally) often necessitate changes in accounting principles to ensure compliance.

- Relevance and reliability: An entity might voluntarily change an accounting principle if it believes that the new principle provides more relevant and reliable information to the users of its financial statements.

- Comparability: To enhance the comparability of its financial statements with those of other entities in the same industry, a company may change its accounting principles.

Accounting Treatment and Disclosure

- Retrospective application: Generally, when an accounting principle is changed, the entity is required to apply the new principle retrospectively to all periods presented in its financial statements. This means adjusting the financial statements for each prior period presented as if the new accounting principle had always been used.

- Cumulative effect adjustment: If it is impractical to apply the change retrospectively to some prior periods, a cumulative effect of the change might be recognized in the opening balance of retained earnings in the earliest period presented.

- Disclosures: The entity must disclose the nature of the change, the reasons for changing the accounting principle, the method of applying the change, and the effects of the change on the financial statements. This includes the impact on line items of the financial statements for the current and prior periods, as well as the cumulative effect on the opening balance of retained earnings or other components of equity.

Challenges and Considerations

Changing an accounting principle is not a decision to be taken lightly, as it can have wide-ranging effects on an entity’s financial reporting. Stakeholders can understand the reasons behind the change and its effects on the financial statements in making informed decisions. Entities must carefully consider the implications of such changes on their financial ratios, covenants, and performance metrics, as well as the potential impact on stakeholder perceptions.

In conclusion, changes in accounting principles are a critical aspect of financial reporting, reflecting the dynamic nature of business and accounting standards. Proper application, along with transparent disclosure, is essential to maintain the trust and confidence of users of financial statements.

Example

To illustrate the accounting treatment and financial statement presentation for a change in accounting principles. Imagine a company, ABC Corp, decided to change its inventory valuation method from First-In, First-Out (FIFO) to Last-In, First-Out (LIFO) at the beginning of 2024 due to LIFO providing a better match of costs and revenues.

Background Information

- Fiscal Year: ABC Corp’s fiscal year ends on December 31.

- Inventory Values at the End of 2023 (Using FIFO): $500,000.

- Inventory Values at the End of 2023 (If Using LIFO): $450,000.

- Retained Earnings at the beginning of 2024: $2,000,000.

- Income Tax Rate: 30%.

Step 1: Calculate the Cumulative Effect of the Change

The difference in the inventory valuation under FIFO and LIFO at the end of 2023 is $50,000 ($500,000 – $450,000). This difference represents the cumulative effect of the accounting change before taxes. The tax effect of this change would be $50,000 * 30% = $15,000.

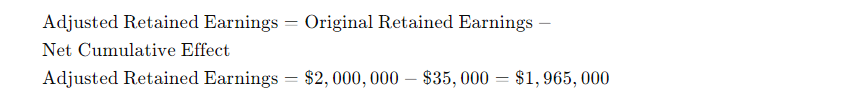

Thus, the net cumulative effect, after accounting for taxes, is $50,000 – $15,000 = $35,000.

Step 2: Adjust Retained Earnings

ABC Corp will adjust its retained earnings at the beginning of 2024 to reflect this cumulative effect. The adjusted retained earnings at the beginning of 2024 would be:

Step 3: Disclosure and Financial Statement Presentation

ABC Corp must disclose this change in its accounting principle in the notes to its financial statements, including:

- The nature of the change (from FIFO to LIFO).

- The reason for the change.

- The fact that the change was applied retrospectively.

- The effects of the change on the financial statements.

In the financial statements, ABC Corp would present the adjusted beginning retained earnings on its balance sheet for 2024. The income statement for 2024 would reflect the cost of goods sold based on the LIFO method, but the comparative income statement for 2023 would not be restated in this example, as we’re focusing on the effect on retained earnings. However, in practice, if comparative financial statements are presented, they would be restated to apply the new accounting principle retrospectively to all periods presented.

Summary of Financial Impact

- Retained Earnings at the beginning of 2024 (Before Adjustment): $2,000,

- Net Cumulative Effect of Change (After Tax): $35,000 decrease.

- Adjusted Retained Earnings at the beginning of 2024: $1,965,000.

Additional Considerations

The example focuses on the direct effect of changing the inventory valuation method on retained earnings and inventory. However, in practice, the change would also affect deferred tax assets or liabilities due to the tax effect of the difference in inventory valuation. If we consider the tax impact more thoroughly, an additional entry to adjust deferred taxes would be necessary to reflect the change in tax obligations that would have occurred if LIFO had been used in prior periods.

Moreover, all related financial statements and disclosures would need to be updated to reflect this change. The notes to the financial statements should include detailed information about the nature of the change, why it was made, and its effect on the financial statements to ensure transparency and provide users with the context needed to understand the impact of the change.

You can find a more detailed explanation of this topic in the following courses:

Changes in Accounting Estimates

Changes in Accounting Estimates are an integral part of the financial reporting process, reflecting the natural evolution of estimates as new information becomes available or as new events occur. Unlike changes in accounting principles, which require retrospective application and are usually less frequent, changes in accounting estimates are applied prospectively and are more common due to the inherent uncertainty in forecasting future events. These changes impact the current and future periods’ financial statements but do not alter previously reported results. Understanding how these changes are accounted for and disclosed is crucial for users of financial statements to assess the entity’s current and future financial health accurately.

Definition and Examples

An accounting estimate is an approximation of the amount associated with an item in the absence of precise means of measurement. These estimates are based on judgment, experience, information available at the time, and assumptions about future events. Examples of accounting estimates include:

- The useful life and residual value of depreciable assets.

- Allowance for doubtful accounts on receivables.

- Inventory obsolescence reserves.

- Warranty obligations.

- Provisions for litigation and contingencies.

Changes in these estimates can result from new information, more experience, or changes in circumstances that affect the assumptions used to determine the estimates.

Reasons for Changes

Changes in accounting estimates are a normal part of financial reporting due to the uncertainties inherent in business operations and the need to base certain financial statement items on forecasted future events. As new information becomes available or as the conditions underlying previous estimates change, entities must adjust their estimates to reflect the best available information at the reporting date.

Accounting Treatment

- Prospective Application: Changes in accounting estimates are recognized prospectively, meaning they affect the carrying amounts of assets and liabilities and the financial results of the period in which the change occurs and future periods if the change affects both.

- No Restatement of Prior Periods: Unlike changes in accounting principles, changes in accounting estimates do not require the restatement of previously issued financial statements because the change is based on new information that was not available when those financial statements were prepared.

Disclosure Requirements

Entities are required to disclose the nature of any change in an accounting estimate and its effect on the current period’s financial results if the effect is material. If it is reasonably possible that the estimate will change again in the near term and the effect of the change would be material to the financial statements, this fact must also be disclosed. The disclosures help users understand the basis of the estimates and the reasons for any significant changes, enhancing the transparency and usefulness of the financial statements.

Challenges and Considerations

The main challenge in dealing with changes in accounting estimates lies in distinguishing them from corrections of errors and changes in accounting principles. While changes in accounting estimates reflect new circumstances or information, corrections of errors pertain to oversights or misapplications of accounting policies. This distinction is crucial because it affects the accounting treatment and disclosure requirements.

In summary, changes in accounting estimates are an essential aspect of financial reporting that ensures the financial statements reflect the best available information. By applying these changes prospectively and providing adequate disclosures, entities can offer transparent and updated insights into their financial position and performance, thereby aiding stakeholders in making informed decisions.

Example

To illustrate how a change in accounting estimate is reflected in the financial statements. Assume XYZ Corporation, a company that manufactures electronic devices, decides to revise the estimated useful life of its machinery due to technological advancements and changes in production processes.

Background Information

- Original Estimated Useful Life of Machinery: 10 years

- Original Cost of Machinery: $1,000,000

- Accumulated Depreciation (after 5 years of use): $500,000 (Straight-line depreciation was used, with no salvage value: $1,000,000 / 10 years = $100,000 per year)

- Revised Estimated Useful Life (at the start of Year 6): 8 years total (3 more years instead of the originally estimated 5 more years)

Objective

To calculate and illustrate the impact of changing the estimated useful life of the machinery from 10 years to 8 years, starting from Year 6.

Step 1: Recalculate Depreciation Based on the New Estimate

- Carrying Amount at the Start of Year 6: $500,000 ($1,000,000 original cost – $500,000 accumulated depreciation)

- Remaining Useful Life after Revision: 3 years

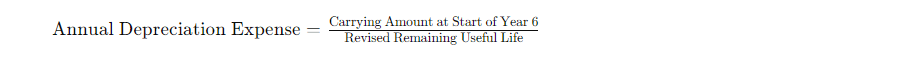

.

The annual depreciation expense for the remaining 3 years is recalculated as follows:

Annual Depreciation Expense = $500,000/3 years = $166,666.67

Step 2: Journal Entry for Depreciation Expense in Year 6

- Debit: Depreciation Expense $166,666.67

- Credit: Accumulated Depreciation $166,666.67

This entry recognizes the depreciation expense for Year 6 based on the revised estimate.

Step 3: Disclosure

XYZ Corporation would disclose in the notes to its financial statements that it revised the estimated useful life of its machinery from 10 years to 8 years, starting from Year 6, due to technological advancements and changes in production processes. It would also disclose the effect of this change, which is an increase in the annual depreciation expense from $100,000 to $166,666.67 for the remaining 3 years of the asset’s useful life.

Summary of Financial Impact

- Before the Change: Annual depreciation expense was $100,000, with 5 more years to depreciate.

- After the Change: Annual depreciation expense increased to $166,666.67, with 3 years remaining.

This example demonstrates how a change in accounting estimate is accounted for prospectively and how it impacts the financial statements. The change does not affect prior periods but does increase the depreciation expense for the current and future periods, thereby reducing the net income compared to what it would have been under the original estimate.

Correction of Accounting Errors

The correction of accounting errors is a fundamental aspect of maintaining the integrity and reliability of financial statements. Errors in financial statements can arise from mathematical mistakes, oversights, misinterpretation of facts, fraud, or the incorrect application of accounting principles. These errors can significantly impact the perceived financial health and performance of an entity, potentially leading to misinformed decisions by users of the financial statements. Therefore, entities must correct any identified errors promptly and accurately, following the established accounting standards and guidelines.

Definition and Types of Errors

Accounting errors are inaccuracies in financial statements that result from a failure to use, or the misuse of, reliable information that:

- Was available at the time financial statements were prepared.

- Could reasonably be expected to have been obtained and taken into account in the preparation of those financial statements.

Errors can include:

- Mathematical mistakes.

- Mistakes in applying accounting policies.

- Oversights or misinterpretations of facts.

- Fraud.

Errors can be distinguished from changes in accounting estimates. Errors result from inaccuracies in gathering or processing data from which financial statements are prepared, not from changes in the conditions or circumstances that underlie an estimate.

Accounting Treatment

The correction of errors is handled by retrospective restatement, except when it is impracticable to determine either the period-specific effects or the cumulative effect of the error.

Retrospective Restatement:

- Errors are corrected by retrospectively restating the comparative amounts for the prior period(s) in which the error occurred.

- If the error occurred before the earliest prior period presented, the opening balances of assets, liabilities, and equity for the earliest period presented are adjusted.

- Adjustments related to periods before those presented are made against the opening balance of retained earnings (or other appropriate category of equity) for the earliest period presented.

Disclosure: Entities must disclose the nature of the error and the impact of its correction on each financial statement line item and any per-share amounts affected for each prior period presented. If it is impracticable to determine the period-specific effects, the fact that it is impracticable, the nature of the error, and how it is corrected are disclosed.

Example Scenario

Suppose Company XYZ discovered in 2024 that it had erroneously expensed a piece of equipment costing $100,000 in 2022, which should have been capitalized and depreciated over five years.

Correction Entry:

- Reverse the Incorrect Expense (Retrospective to 2022):

- Debit: Expense $100,000 (to reverse the incorrect expensing)

- Credit: Equipment $100,000 (to capitalize the equipment)

- Record Accumulated Depreciation for 2022 and 2023:

- Assuming straight-line depreciation with no residual value, annual depreciation is $20,000.

- Debit: Accumulated Depreciation $40,000 (for two years)

- Credit: Depreciation Expense $40,000

- Adjust Opening Retained Earnings for 2024:

- The net effect on retained earnings as of the beginning of 2024 reflects the correction of the error minus two years of depreciation expense ($100,000 – $40,000 = $60,000 adjustment to retained earnings).

Disclosure: Company XYZ will disclose in its 2024 financial statements:

- The nature of the error (incorrect expensing of equipment).

- The impact on financial statement line items for 2022 and 2023, as well as the cumulative effect on the opening balance of retained earnings for 2024.

- Comparative information would be restated to reflect the correction.

Conclusion

The correction of accounting errors is crucial for ensuring that financial statements provide a true and fair view of an entity’s financial position, performance, and cash flows. By retrospectively correcting errors and providing transparent disclosures, entities uphold the reliability and credibility of their financial reporting, fostering trust among investors, creditors, and other stakeholders.

Changes in Reporting Entity

“Changes in Reporting Entity” refers to adjustments in the structure of the group of entities whose financial information is presented within consolidated financial statements. This change can occur due to several reasons, such as a company deciding to consolidate or de-consolidate its subsidiaries, reorganizing its structure, or changing its method of applying the equity method for investments. These changes require specific accounting treatment and disclosure to ensure the financial statements provide a clear, complete, and comparable view of the reporting entity’s financial position and performance over time.

Definition and Types

A change in reporting entity happens when:

- There’s a change in the composition of entities that constitute the reporting entity: This could involve entities being added or removed from the group. Examples include acquiring or losing control of subsidiaries or changing the entities included in combined financial statements.

- There’s a change in the method of accounting for its subsidiaries or investees: Switching between the consolidation method and the equity method, or vice versa, due to changes in the level of control or significant influence over these entities.

Reasons for Changes

- Business Combinations and Dispositions: Acquiring or disposing of subsidiaries can change the group of entities that are consolidated.

- Reorganizations: Corporate restructurings might lead to a different set of entities being presented as the reporting entity.

- Change in Control or Influence: Gaining or losing control over an entity or significant influence over an investee can lead to changes in how these entities are accounted for in the financial statements.

Accounting Treatment

- Retrospective Application: Changes in the reporting entity are applied retrospectively. This means that all prior-period financial statements presented are restated as if the new reporting entity existed in all those periods. This approach helps in maintaining comparability across periods, allowing users to make consistent comparisons.

- Restatement of Comparative Financial Statements: When a change in reporting entity occurs, comparative financial statements must be restated to reflect the change. This ensures that the financial statements present information as if the current structure of the reporting entity had been in place in all previous periods presented.

Disclosure Requirements

Significant disclosures are required when there’s a change in the reporting entity, including:

- The nature of the change: A description of how the reporting entity has changed.

- Reason for the change: Why the reporting entity was altered?

- Effect of the change: The impact on the financial statements, including details of any restatements made to prior periods. This often involves presenting as if the entities included or excluded were always part of the reporting entity (or not) in all periods presented.

Example Scenario

Imagine a corporation, ABC Group, that operates with three subsidiaries. In 2024, ABC Group acquired a new company, XYZ Co., which is significant enough to require consolidation. This acquisition changes the reporting entity because financial statements in future periods will now include XYZ Co.

For comparative purposes, ABC Group must retrospectively adjust its financial statements to include XYZ Co.’s results and financial position as if XYZ Co. had been a part of ABC Group in all prior periods presented. This involves adjusting previous years’ revenues, expenses, assets, and liabilities to include those of XYZ Co., ensuring that the financial statements offer a like-for-like comparison over time.

Challenges and Considerations

Changes in the reporting entity can be complex and resource-intensive, requiring significant effort to gather historical data and restate prior periods. It’s crucial for entities undergoing such changes to maintain transparency and provide thorough disclosures to help users understand the impact of these changes on the financial statements.

In summary, changes in the reporting entity are significant events that require careful accounting and disclosure to ensure the financial statements remain useful and comparable over time. This approach supports the core financial reporting objectives of providing information that is relevant, reliable, and comparable across reporting periods.

Responses